Articles

Send they on the Irs at the time and place you perform if you don’t file a tax come back. While you are needed to document Form 8606 nevertheless aren’t needed to file an income tax go back, you need to nonetheless document Function 8606. Do not is costs on the tax come back from claims lower than legislatively considering personal work for software on the strategy of your own standard hobbies. You ought to were kickbacks, side income, push money, otherwise similar money you will get on the money for the Plan step 1 (Form 1040), range 8z; or on the Agenda C (Setting 1040) in the event the out of your mind-a job hobby. For those who discovered repayments you have to use in your revenue therefore’re also in operation as the a foster care supplier, statement the fresh money to the Plan C (Function 1040). Use in your revenue all payments obtained from your own bankruptcy property to own handling otherwise working a swap otherwise organization which you manage before you recorded to have bankruptcy.

Fullwidth Yen Sign

The brand new income tax speed to have Medicare is web site here actually step one.45% (count withheld) per to the staff and you will company (2.9% total). For 2026, the new societal defense income tax price is actually 6.2% (amount withheld) for every on the employer and you may worker (a dozen.4% total). Subtract the fresh worker income tax from for every wage payment.

Halifax Business

The fresh hospitalization ought to be the results of a personal injury received when you’re helping inside a battle area or a backup operation. step three for lots more detailed information on the urban centers comprising for each and every treat area. To own purposes of the fresh automated extension, the term “handle zone” boasts next parts. To find out more, see Submitting and you can Payment Due dates within the Bar. To utilize so it automated expansion, you should install a statement on the go back describing exactly what situation qualified you to the expansion. If you offered inside a fight zone or qualified harmful duty area, you are entitled to an extended extension of your energy to file.

The brand new the main shipping that you can roll over is actually the brand new area who if not end up being nonexempt (includible on your money). A cost folded more tax-free in one later years decide to various other could be includible in the money when it is delivered from another package. You will have to pay a $fifty punishment if you don’t document an essential Form 8606, if you don’t can be the failure is because of sensible result in. For many who overstate the level of nondeductible benefits on your own Function 8606 for your income tax 12 months, you need to shell out a penalty from $a hundred for every overstatement, unless it had been because of realistic trigger.

A lot of Team Losses Limit for Noncorporate Taxpayers (Point

You’re permitted document your own 2025 go back because the a good qualifying thriving spouse for many who satisfy the pursuing the testing. It does not entitle you to definitely document a shared return. You are permitted document since the lead from home also if the boy that is the qualifying people could have been kidnapped.

Once you consult Internal revenue service assist, anticipate to deliver the after the suggestions. Your boss is required to give or send Form W-2 for you no afterwards than just March dos, 2026. It also demonstrates to you how to done particular sections of the form. 3 for additional info on qualified hospitalizations.

Although not, we both chat to other persons if we you need information one you’ve been not able to offer, or to make sure guidance i have acquired. When we examined their get back for the same contents of sometimes of your own dos prior many years and you can recommended zero switch to their income tax accountability, e mail us as fast as possible so we are able to see if the we want to stop the newest examination. We are going to send you a page that have either an ask for considerably more details or a description the reason we faith a change to the go back may be needed. When we determine that the info is accurate and you may reputable, we could possibly utilize it to select a return to possess test.

- See the Function W-4 recommendations for more information.

- It count is significantly down to possess married those who document on their own and you can lived together with her when in the year.

- You will have an application W-2 out of per employer.

- You could get ready the new taxation go back your self, see if your be eligible for totally free tax thinking, or hire a tax elite group to prepare their get back.

- If you are a U.S. citizen and now have a bona fide citizen of Puerto Rico, you need to generally file a U.S. taxation go back for the seasons the place you meet the earnings criteria.

Contributions by the a collaboration to help you a partner’s HSA for features made are addressed while the guaranteed money you to definitely is includible on the partner’s revenues. Withdrawals from your own HSA that are familiar with spend qualified medical expenses aren’t utilized in your revenue. Contributions produced by your employer aren’t used in your earnings. In case your boss provides a keen HRA you to definitely qualifies while the a major accident or fitness bundle, exposure and you may reimbursements of your health care expenditures fundamentally aren’t used in your earnings. Contributions by your boss on the Archer MSA fundamentally aren’t utilized in your earnings.

- For those who don’t pay enough income tax from the deadline of each and every payment several months, you are recharged a punishment even although you are due a reimbursement when you file your earnings income tax come back.

- See Internal revenue service.gov/Forms so you can obtain variations and you can publications.

- For many who reveal an enthusiastic overpayment away from taxation after finishing your Mode 1040 otherwise 1040-SR for 2025, you could apply part otherwise it all to the estimated tax for 2026.

- You could make contributions so you can a good Roth IRA to possess annually any time inside season otherwise by due date of one’s come back for this 12 months (excluding extensions).

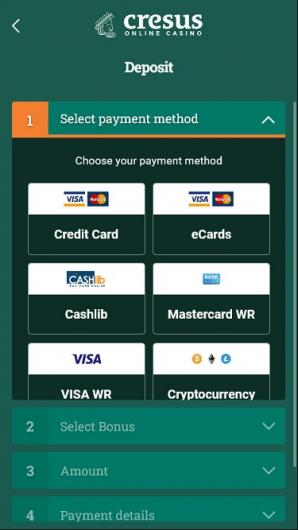

You also wear’t you desire coupons otherwise deposit incentive codes to locate it 100 percent free currency. But we discovered several put incentive code now offers and you will Flames Kirin discounts you to established people can also be claim to your tricky brands holding Flame Kirin. You cannot withdraw the new Fire Kirin no deposit bonus after it’s paid for you personally. You’ll also need to be at least 21 years old in order to claim that it render. But be wary of your hazard hiding on the shade away from it sweepstakes system. With regards to stating the brand new Flames Kirin no-deposit bonus, there is certainly they a breeze.

Usually do not are the excise taxation for the coal from the sales rates when choosing and therefore tax price for Irs Nos. thirty-six, 37, 38, and you can 39. It report is submitted to your earliest one-fourth Form 720, that’s owed before Could possibly get 1 of every year. The fresh step one% tax doesn’t affect advanced paid off to your an insurance policy away from reinsurance given by the one overseas reinsurer to another foreign insurance company otherwise reinsurer, beneath the points described in the Rev. Rul. The brand new tax is a dozen% of your own conversion process speed to the earliest shopping sales of each tool.

Commentaires récents